Free Tax Prep Support

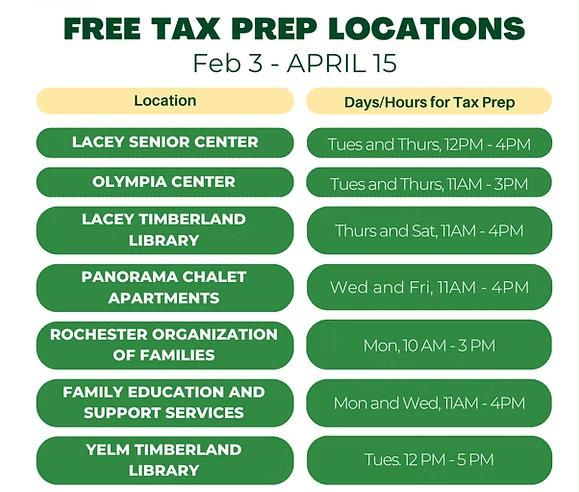

AARP Foundation Tax-Aide offers free tax preparation in Thurston County with appointments beginning Feb 3, 2025 and ending April 15, 2025.

Make an Appointment

Call 360-347-6276, schedule online, or visit any of the sites during open hours.

Services Provided

- File taxes for any/all of the last three tax years (they can help with most common types of tax filing situations)

- Apply for the Working Families Tax Credit

Who Qualifies?

- People of all income levels

- People of all ages

- People with a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN)

Tax Situations They Can’t File

- Some self-employment and rental income situations

- Capital gains or losses from futures or options

- The sale of virtual currency such as bitcoin

- Hobby income

Tax Credits You May Qualify For

Working Families Tax Credit

Individuals and families may receive up to $1,255 back if they meet certain eligibility requirements. You can apply even after tax season is over.

Earned Income Tax Credit

If you are low to moderated income, you may qualify for this tax credit. To received this credit, you need to apply by April 15, 2024.